Highly systematic financial forecasting

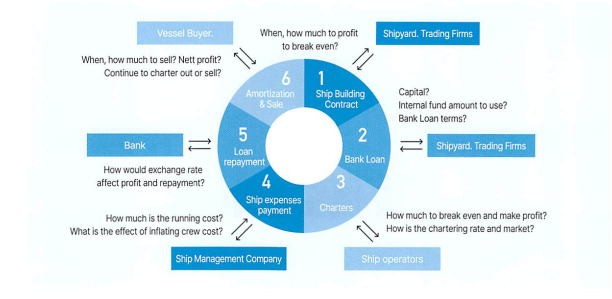

For shipowners looking to expand their profits, fleet expansion is essential. However, new build vessel requires a large capital investment, and long-term decision-making is necessary to recoup the investment over an extended period. TRANS-Owner is a solution that efficiently provides highly accurate financial forecast information.

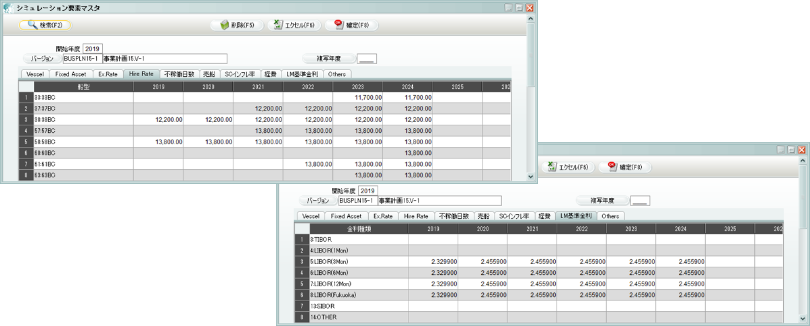

Flexible simulation elements

By forecasting variable factors such as future charter rates, fluctuating interest rates, exchange rates, and inflation rates, it is possible to measure their impact on future profit and loss, as well as cash flow. The forecasted values of the simulation elements can be version-controlled, allowing comparisons of financial forecasts for different scenarios, such as optimistic and pessimistic cases. Additionally, by predicting the timing and selling price of vessels, it is possible to simulate the final return on investment.

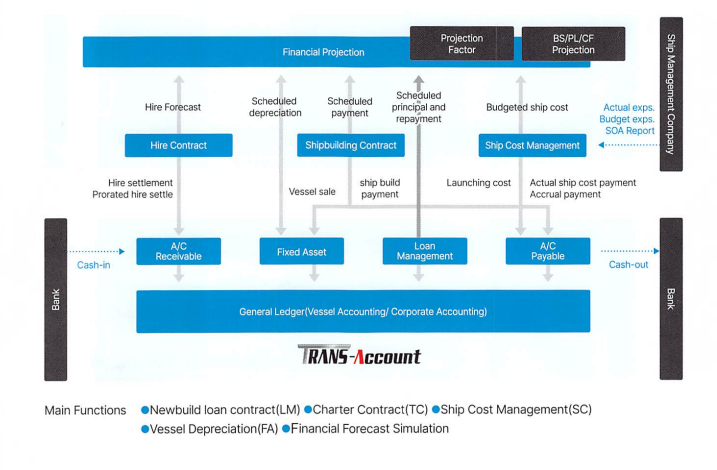

Accelerate financial closing with the integration of accounting system

The various contract information stored in TRANS-Owner is not only used for financial forecasting but also integrates seamlessly with TRANS-Account (the accounting system). Since this contract information is also used in daily operations, accuracy improves and the system becomes firmly established. Furthermore, accounting entries such as recording of unearned interest, allocation of charter fees over time, and depreciation are automated, leading to faster financial closing.

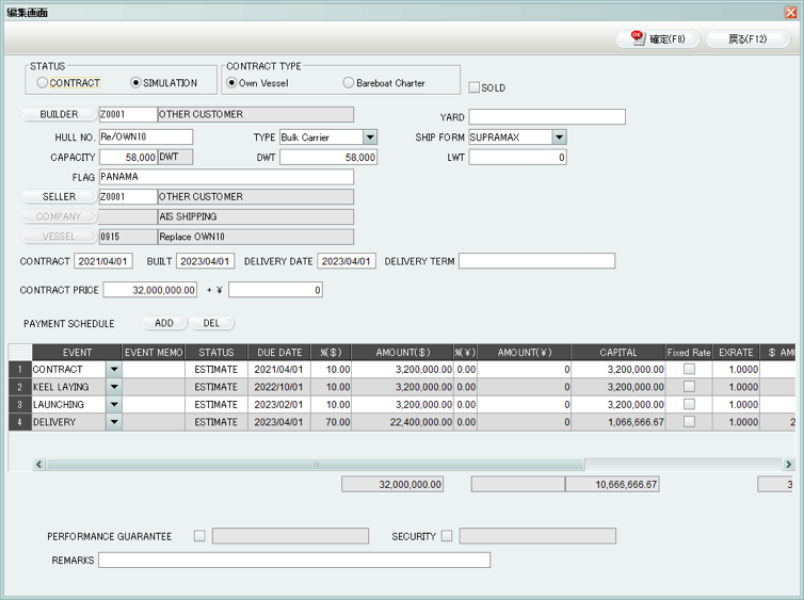

Shipbuilding contract

To purchase a vessel, a shipbuilding contract is signed with the shipyard, and multiple payments are made to the shipyard based on progress of the project such as Contract, Keel-Laying, and Launching until Delivery. First, the contract details and payment schedule are registered as shipbuilding contract information. At the time of each payment, the payment request data to the shipyard is interfaced to the accounting system.

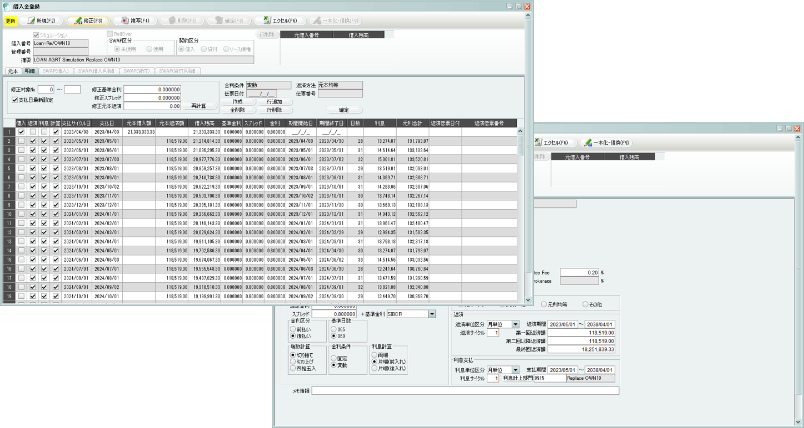

Loan Agreement (LM)

For shipowners looking to expand their profits, fleet expansion is essential. However, new build vessel requires a large capital investment, and long-term decision-making is necessary to recoup the investment over an extended period. TRANS-Owner is a solution that efficiently provides highly accurate financial forecast information.

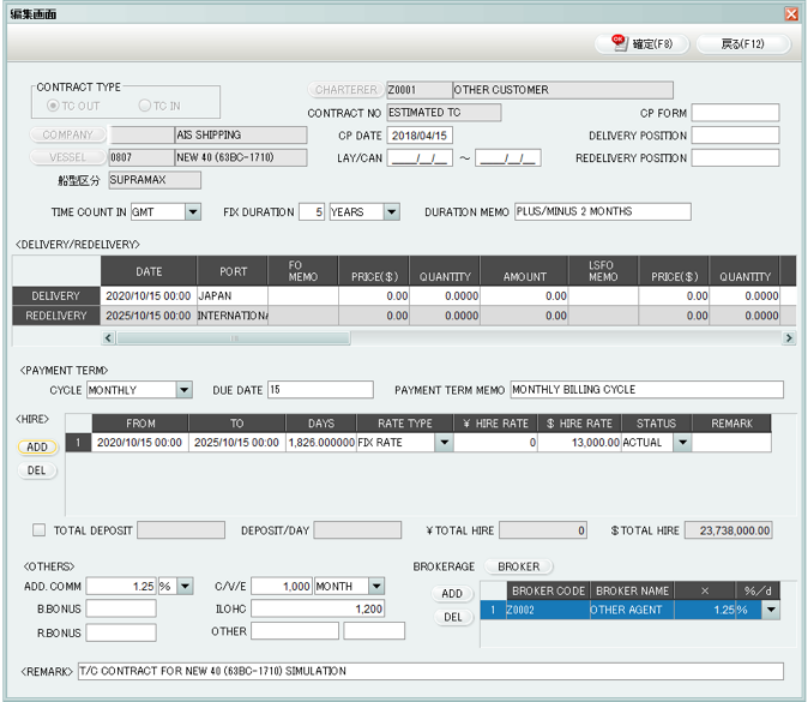

Charter Party (TC)

A charter contract is concluded with a charterer and receive charter hire income during the charter period. Charter contract information which included the charter period and charter hire rates is registered in the TC management module*. In addition, by entering HIRE STATEMENT information into the TC settlement entry, charter hire settlement vouchers and charter hire ledgers are created. At the end of the fiscal year, entries for the allocation of charter hire over the period are automatically generated and interfaced with the accounting system.

*Note: A separate TC management module is required

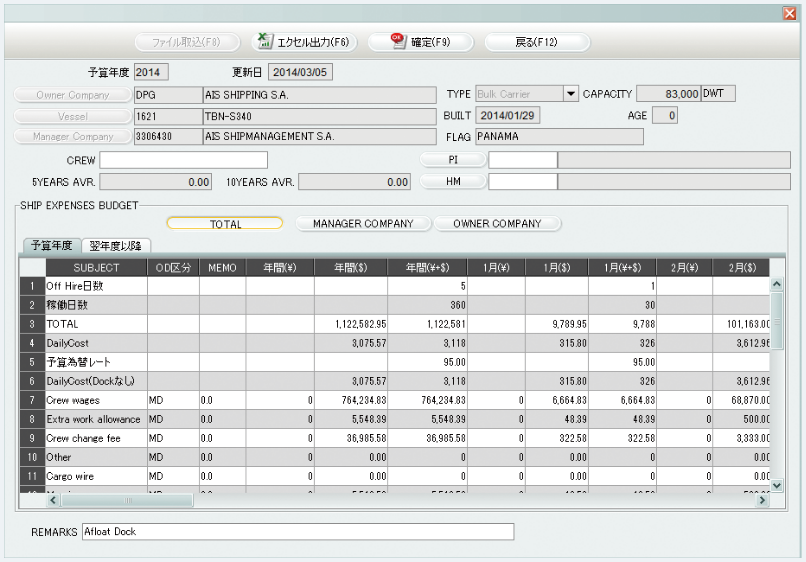

Shipmanagement Cost (SC)

After delivery, ship management expenses are incurred as running costs.Usually, ship management companies are entrusted with managing these costs which included setting annual budgets, and handling crew assignments and maintenance. Annual budgets agreed with the ship management company and budgets for company’s own arrangements are registered in the ship management module* for each expense and month. For forecasting ship expenses after the budget year,a simulations are conducted using inflation rates for each expense category. Docking costs can also be entered along with the OFF HIRE days for the relevant year.

In addition, the monthly advance payment request data to the ship management company is interfaced with the accounting system based on the ship cost budget information. By entering necessary data from the required stages for budget management, it is possible to manage actual versus budgeted costs, including backlogs.

*Note: A separate ship cost management module is required.

Enhanced Purchasing Features!!

This new feature allows for comprehensive management of procurement activities, not only handling simple purchasing management functions but also overseeing the entire procurement process. It includes:

1. Purchase requests from the vessel.

2. Request for quotes to suppliers via email.

3. Automatic retrieval of quote amounts.

4. Quote comparison functionality.

5. Ordering and accounting for shipping costs and allocation.

6. Automatic creation of accounts payable vouchers.

7. Creation of aggregate payment and remittance data.

The system supports foreign currencies and English input, with automatic conversion to Japanese yen. It includes standard features for both yen and dollar budget comparisons. Additionally, you can reverse lookup past quote amounts by product classification for price comparison and evaluation before placing orders. If an order is delivered in multiple shipments, the system can generate accounts payable data for only the delivered portions.

The system also automatically determines and inputs optimal accounting entries for budget management, including estimated unpaid amounts for invoices not yet received. This system significantly accelerates the efficiency of the entire procurement process and is offered as a highly anticipated solution.

Financial Forecast Simulation

Using simulation elements for shipbuilding contracts, loan agreements, charter contracts, ship cost budgets, and depreciation schedules, financial forecasts (B/S, P/L, C/F) are carried out throughout the vessel’s lifecycle, from construction to sale

1. Foreign Exchange Forecast Information

Using annual forecasts of exchange rates for dollar-denominated transactions, dollar-based income and expenses are converted into yen

2. Variable Interest Rate Forecast Information

Using annual forecasts of benchmark interest rates (such as LIBOR or TIBOR), the interest payments on loans are predicted.

3. Charter Hire Forecast Information

Using annual forecasts of charter hire rates for different ship types, charter hire income is predicted by multiplying the charter hire rate by the number of operational days

4. Ship Cost Inflation Rate Information

Using the inflation rates for each ship cost item, the annual budget amounts for ship costs are forecasted

5. Planned Vessel Sale Information

By registering the planned sale amount and sale date of a vessel, the forecasted gain from the sale can be calculated. Various simulation elements can be managed as versions, allowing for comparative financial forecasts for each version